2G Magazine's International Ideas Competition

for the Venice Lagoon Park

This was the official website for the 2G magazine's international ideas competition for the Venice Lagoon Park. The contest was for only theoretical ideas without definitive plans for the development or execution of the actual project.

The jury The jury was composed of the prominent architects: Inaki Ábalos, Francesco Careri, James Corner, Anne Lacaton and Phillippe Rahm, together with Team 2G. Winner were announced in 2008.

Content is from the site's 2007 archived pages as well as from other outside sources.

OVERVIEW

On the occasion of the celebration of the magazine's tenth anniversary, 2G launches a second international ideas competition

Category: Idea Competition / Competition Result / Open to Students

Type: International Urban Design Idea Competition

Genre: Landscape

Country: Spain

Registration Deadline: 15 Oct 2007

Eligibility: Students and Professionals under 40 in the field of architecture but also within the field of landscape design, urbanism and related disciplines, as long as they include a student of architecture or an architect in their team.

"I was turned on to this competition by a well known lawyer friend who is also an avid architecture maven. He bugged me for several weeks to pay a visit to this site before I finally relented. Benjamin Pred - you may know him for this extreme exercise ordeal, or as the Frisbee throwing former Queens Assistant District Attorney - raved about the images on this site and I now agree. I think the competition drew the artists out of the otherwise often technical discipline of architecture, and the proof is on these pages. Very impressive indeed." Laura Standish

"We reported on this organization and the winners of their creative competition. These are idea contests that enable considerations from outside the box to influence mainstream thinking. Because we have offices both in the US and in Paris, we often see events with a slightly different perspective. I don't believe there were any entrants for the US but we still reported on the results and we noticed something very unusual. Google serves different results based on the country where the search initiates. This makes sense in terms of language and culture, but we observed something way beyond explanation. From my office in Paris, a search in Google for "International Urban Design Idea Competition" got me right to this site. But searches from our office in NYC showed sites for pig nutrients and snow removal equipment. We are aware that Google occasionally screws up, but this was mind blowing. It lasted long enough so that I was just about to do a separate story on the harm caused by Google's mistakes when it reverted to a more accurate result set." Jan Petersen, UpNews

PRESS RELEASE

2G contest:Contest

To celebrate its 10 years, 2G magazine convenes an international ideas competition for the Venice Lagoon Park. The initial approach of the contest proposes a reflection on contemporary metropólis from the landscape project and the tension between global interests and local needs. The place chosen for the development of the program has been the Venice lagoon and the theme the creation of the Venice Lagoon Park.

The park project will seek to recover the urban idea of the lagoon as a complex network of communications and settlements through the hypothetical re-colonization of its territory, the decentralization and atomization of a program of uses and the recovery of the lagoon as an urban constellation necessarily integrated into its natural environment. The program to devise this recovery will consist of an Urban Park and Lagunares Prototypes.

This contest is ideas, theoretical and does not imply development or execution of the project. The jury is composed of prominent architects: Iñaki Ábalos, Francesco Careri, James Corner, Anne Lacaton and Phillippe Rahm, together with Team 2G.

The period of consultation of the bases has passed, and these will be published on July 2, 2007.

The deadline for registration is October 15, 2007. Projects must be delivered no later than November 12, 2007, at 2:00 p.m. Barcelona time. The results will be published during January 2008.

Description

The competition is intended as a reflection on the contemporary metropolis that, growing out of the design of the landscape, pays attention to the tension between global interests and local needs. The site chosen for the unfolding of the competition is the Venice Lagoon, the specific theme being the creation of the Venice Lagoon Park.

The park project will be devoted to reclaiming the urban idea of the lagoon as a complex network of communications and settlements, through a hypothetical re-colonisation of the territory of the lagoon, the decentralisation and atomisation of a programme of uses, and the reclaiming of the idea of the lagoon as an urban constellation necessarily integrated in its natural environment. The programme for planning this rehabilitation will consist of an Urban Park and Lagoon Prototypes.

Jury

Iñaki Ábalos

Francesco Careri

James Corner

Anne Lacaton, president

Philippe Rahm

2G Team

Competition Type

One-Stage

Prize

First prize: 10,000€ plus a year's subscription to the magazine 2G

Second prize: 5,000€ plus a year's subscription to the magazine 2G

Five special mentions: Rewarded with a year's subscription to the magazine 2G

The winning, finalist and selected projects will be shown as part of the Venice Biennale di Architettura in Autumn 2008.

Entry Fee

EURO 30 Students, 60 Professionals

Entries

A maximum of 2 DIN A1 panels (841 mm x 594 mm), and CD with the competition panels in jpg and pdf format

Timetable

Publication in the webpage of the jury's verdict and of the competition records: January 2008

Publication of the prize-winning and selected proposals: first six months of 2008

2G Competition: Venice Lagoon Park 1st Prize Winners

The Paris team BuildingBuilding, consisting of the architects Thomas Raynaud-team leader-and Cyrille Berger, has won First Prize in the 2G Competition. Venice Lagoon Park for entry presented with the slogan Drip Feed.

Some Proposals for a Venice Lagoon Park

Saturday, February 02, 2008 | https://pruned.blogspot.com/

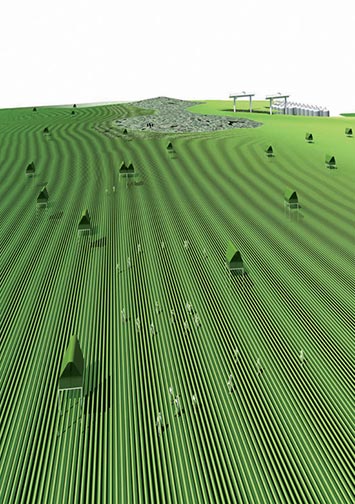

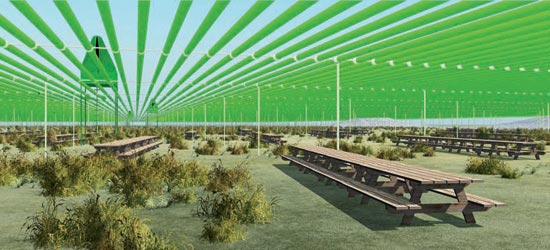

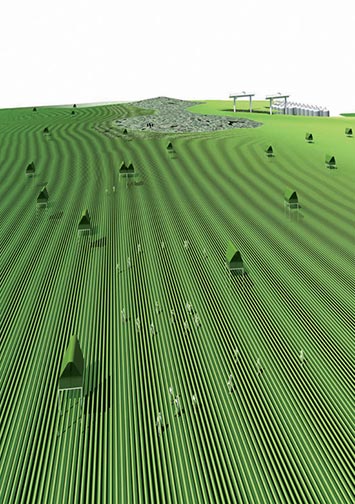

First is the winning entry from architects Thomas Raynaud and Cyrille Berger. Presented with the slogan Drip Feed, they propose to turn one of the islands in the lagoon into a sort of algae power farm using organisms that already live in the tidal marshes to convert water pollution into clean energy.

It'll be a site of production and leisure.

Or as described by the Paris team: “Our project for the urban park of Sacca San Mattia consists of reinvesting the island in a Venetian, multi-functional approach to urban planning, in the context of an enlarged metropolitan, tourist centre. The Drip Feed project on the Island of Sacca San Mattia puts into place an above-ground ulva rigida cultivation device that is in keeping with the Greenfuel system. A saprophyte structure that ingests polluted waste from local industry, and conceptually redefines the lagoon’s future water level, without harming the natural state of the island.”

(Combining clean energy production and public space. Drip Feed by Thomas Raynaud and Cyrille Berger.)

(Picnicing under an algae-filled trellis pavilion. Drip Feed by Thomas Raynaud and Cyrille Berger.)

Second is the entry from the Spanish team of Josep Tornabell Teixidor, Gerard Bertomeu, Miriam Cabanes and Enrique Soriano. Called Instant Gel, their proposal also makes use of existing water-borne organism and pollutants but this time they are to be used to set off a chemical reaction with layers of flexible gelly structures, creating fantastical island-sized foamy water lilies.

(Instant Gel by Josep Tornabell Teixidor et al.)

The cranes in the image above suggest perhaps that in the future climate-changed Venice St. Mark's will be transferred onto one of these floating islands.

Or perhaps Askin Ozcar's fake Venice will be realized here. Duplicate canals, duplicate churches, duplicate palazzos, duplicate Venetians and duplicate film festival and biennales, all floating above and tethered to the lagoon. And every couple of years (another biennale of sorts), it gets disconnected to become a mobile museum, mall and casino.

(Exploring the underwater gardens of Venice or perhaps of an other world. Instant Gel by Josep Tornabell Teixidor et al.)

2G Competition: Venice Lagoon Park 2nd Prize Winners

2G Competition - Venice Lagoon Park, Italy

competition 2nd prize, 2008

project title: [500m apart]

design team: Johanna Irander, Nicolo Riva, Nicole Carstensen, Samuel Austin, Nuno Gonçalves Fontarra

client: 2G Magazine

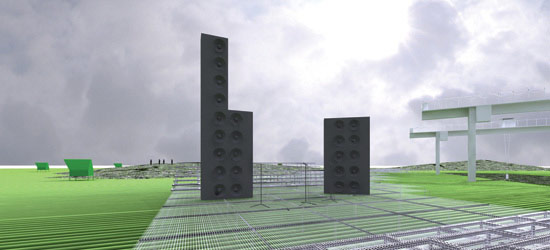

The design of the urban park on the island of Sacca San Mattia, situated in the Venetian lagoon, is divided into four areas; a square, a pavilion area, a salt water pond with red algae and a plantation of pine trees.

The lagoon is represented by a land art installation, whereinformation from lagoon prototype sensors is being displayed on a screen wall. Steel rods are distributed across the lagoon in a 500m square grid. A sensor is attached to each, which registers movement within a defined radius and transmits images and information to the base at the island of Sacca San Mattia.

Projected onto a 5m high screen wall, this data becomes an abstract representation of the lagoon, with which visitors may interact. Lagoon activity is visualised on the wall in a changing reality of pixels that map the movement of unseen waters. The currents, cycles, processes and activities interweave - the presence of the lagoon can be felt.

VENICE / lagoon park

Finalist project

2G Venice Lagoon park international competition

2007

Design: Luis Callejas, Edgar Mazo, Sebastian Mejia and Juan Pablo Martinez

Collaborators: Erica Martinez

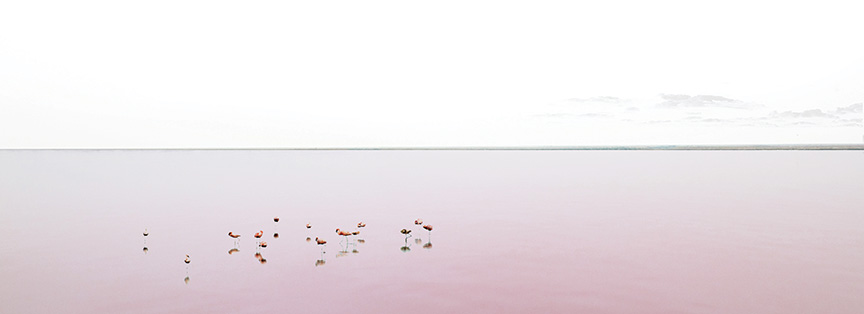

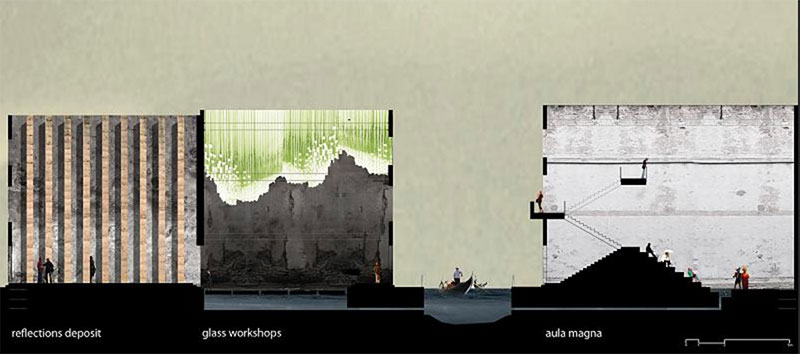

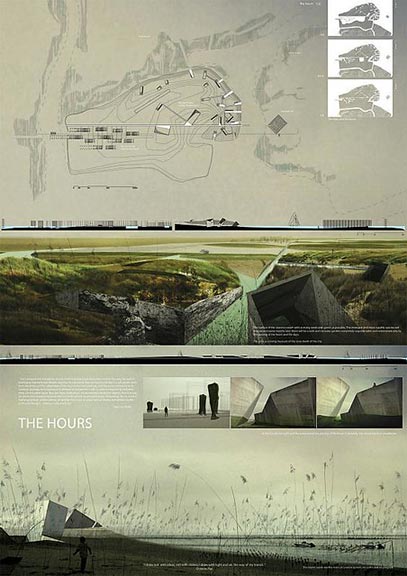

As a canonical case of aquatic urbanization, the Venice Lagoon in Italy serves as an ideal ground for tactical interventions that trigger new forms of public life ultimately tied to aquatic events. Varying in scope and scale, the project strategically intervenes at the building scale of decaying houses threatened with collapse and from a tidal park at the vacant island of Sacca San Mattia to the territorial scale of an artificial reef to recover the lagoon’s ecology.

Removing the roofs but conserving the facades transforms residential buildings into open public spaces as they become abandoned or obsolete due to water damage. New gardens, galleries, small parks, and public baths appear behind their walls, eventually generating a decentralized system of dispersed yet connected micro-parks. Second, as a means of forecasting future landscape and climate events, the uninhabited island of Sacca San Mattia becomes a testing ground for the amplification and replication of the almost invisible, slow drowning of Venice. Through its simple features such as canals and trenches, the paths of the new park on the island register tidal cycles, to the extent of becoming inaccessible during high tide. Third, as territorial infrastructure, the artificial reef aims to protect and preserve weakened ecologies in the lagoon resulting from the constant traffic of the Vaporetto system of public ferries. Thus, the reef becomes both a highway for boats as well as a hotbed for the lagoon ecosystem, to eventually disappear from view under the rising tides of the lagoon

Finalist project 2G Venice Lagoon Park, international competition 2g Magazine Barcelona, Spain 2007 Proyect: Luis Callejas, Edgar Mazo, Sebastián Mejia, Juan Pablo Martinez

The park as a living museum of the slow death of the city.

/images/luis-callejas-vista-general.jpg

The Venice lake is colonized by an artificial reef system that intends to recover, keep and protect a living fertile ecosystem. With the change of the tides the reef emerges and disappears partially.

inside the canals the light and water level reveal the passing of the hours. Eventually the canals get flooded and become unwalkable.

The surface of the island is covert with as many seeds and spores as possible, the strongest and most capable species will impose and some months later there will be a completly unpredictable, wild and convulse garden.

The island coasts are the main circulation system, no paths and no program.

“I draw, not with ideas, not with stones; but with light and air the way of my transit.” Octavio Paz

Naos, Water clock house and confined forest. The residential and workshop constructions of the city of Venice, Murano and the other islands are colonized by contemplative uses as they are abandoned or become obsolete . Roofs are removed, walls stay, new gardens emerge, sitting rooms that will eventually get flooded. New decks, galleries, small parks and public thermae appear within the old walls in an unplanned way.

“there is nothing built on stone. Everything is built on sand, but it is our duty to edify as if the sand should be stone” Jorge Luis Borges

Inside the canals the light and water level reveal the passing of the hours. Eventually the canals get flooded and become unwalkable.

WINNERS

2008 Magazine 2G, Barcelona (ES)

2G Competition on the occasion of the celebration of the magazine's tenth anniversary, 2G launches on international ideas competition. Venice Lagoon Park. This theoretical initiative, which does not involve subsequent phases of the project or its execution, is an inducement to free, non-restrictive reflection, the objective to embark on a worthwhile debate within the profession.

The competition is intended as a reflection on the contemporary metropolis that pays attention to the tension between global interests and local needs. The site is chosen for the Venice Lagoon Lagoon Park.

The park project aims to reclaim the urban idea of the lagoon as a complex network of communications and settlements, through a hypothetical re-colonization of the territory of the lagoon, the decentralization and atomization of a program of uses, and the reclaiming of the idea of the lagoon as an urban constellation is absolutely integrated in its natural environment. The program for planning this rehabilitation will consist of Urban Park and Lagoon prototypes.1st Prize

Thomas Raynaud, Cyrille Berger, France

2nd Prize

Johanna Irander, Nicole Carstensen, Nicolò Riva, Nuno Gonçalves Fontarra, Samuel Austin, Holland

Honorable Mention

Gauthier Le Romancer, Guillaume Derrien, France

Honorable Mention

Michele Brunello, Giovanni Roncador and Constantina Verzi , Italy

Honorable mention

Josep Tornabell Teixidor, Gerard Bertomeu, Miriam Cabanes, Enrique Soriano, Spain

Special mention

Giacomo Summa, Paolo Capri, Andrea Zanderigo, Pier Paolo Tamburelli, Silvia Lupi, Francesca Torzo, Vittorio Pizzigoni, Lorenzo Laura, Chiara Pastore, Italy

Honorable Mention

Pierre Bélanger, Ed Zec, Behnaz Assadi, Canada

Honorable Mention

Anders Berensson, Ulf Mejergren, Sweden

Honorable Mention

Aymeric Olry, Jeremy Bernier, France

Dossier: Venice Lagoon Park (2G Books) Paperback – 2008

by Anne Lacaton (Author)

2G Competition. Venice Lagoon Park series: 2G Dossier The 2G Competition. Venice Lagoon Park was convoked in April 2007 in connection with the celebration of the tenth anniversary of the magazine 2G. The contest proposed a multidisciplinary treatment of an architectural and landscape design intervention on a territory -the Venetian lagoon- with a long and intense historical trajectory. At present, the lagoon constitutes a rich ecosystem subject to a wide variety of uses tourist, -residential, industrial, farming- which are difficult to reconcile and to re-elaborate. The 2G Competition delimited and determined this complex reality so as to emphasise, using a real example, many of the issues posited by current architectural debates, and the success of this approach was reflected in the more than 1000 registered competitors from all over the world and the upwards of 500 projects presented. This volume of 2G Dossier contains the competition's winning projects, special mentions and a major selection of schemes that were singled out as finalists by the jury. With the freedom that an ideas competition gives, the whole offers an ample display of the different approaches used, from the most innovatory and risk-taking to more orthodox, rigorous proposals. The jury members Iñaki Ábalos, Francesco Careri, James Corner, Anne Lacaton, Philippe Rahm and other specialists in architecture and landscape design have written texts that complement the schemes presented by the competitors.

Product details

On Amazon

- Paperback: 100 pages

- Publisher: Gustavo Gili; 1st edition (2008)

- Language: English

- ISBN-10: 8425222508

- ISBN-13: 978-8425222504